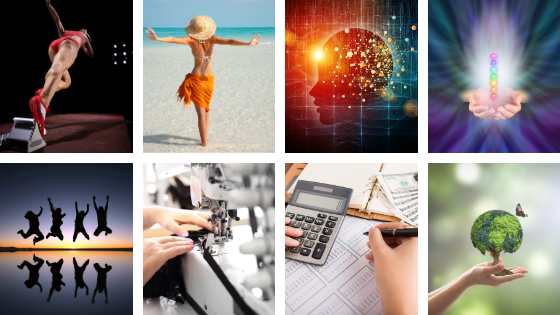

Aligning all 8 Dimensions of Health and Wellness

8 Dimensions Health Wellness Health and Wellness have been a big focus in my life. I started teaching Aerobics when I still in High School and took over my Mom’s gym shortly after I finished school. A couple of years later I also started studying and practising a number of different modalities, including Aromatherapy, Reflexology […]

Aligning all 8 Dimensions of Health and Wellness Read More »